20 Nov The future of Bolivian natural gas exports to Brazil

In 2019 will end the largest national Bolivian project of the last 50 years. A project intiated and agreed between Bolivia and Brazil during the devalued “neoliberal era”, a project that interestingly fed us in the so-called “Socialism of the 21st century”. In fact, half of the Bolivian economic growth of the last 10… yes 10 years, is because the export of natural gas from Bolivia to Brazil. The next year the initial GSA will end, and the main question remains: What will be the future?

There are many, many topics that I could discuss in this post. From our low certified reserves of natural gas, poor exploratory campaigns, the aggressive diplomatic policy we (as Bolivians) had with Petrobras during the “nationalization” euphoria, the absence of new markets (Paraguay and Peru are very small), the insufficient policy of natural gas industrialization, in short, there is a lot of material to be cut, but now I want to concentrate on some questions that usually the media ask me. I must say that this discussion was raised in a paper that we wrote with a good colleague (Jorge Gumucio) some months ago and you can download it in this link, naturally all the comments will be welcome.

Will Brazil still buy natural gas from Bolivia? The answer is yes, perhaps not at the current volumes and prices, but with high probability it will. Why do I have this kind of certainty? Because it turns out that when very few wanted to finance the pipeline (back in the nineties) Petrobras agreed to finance the construction and after Bolivia “will pay with gas.” In technical jargon this part of the contract is called TCO (Transport Capacity Option). Have Bolivia already paid the entire cost of the pipeline? The answer is no. To complete its payment, Bolivia must, at least, deliver 6 million cubic meters per day for 20 more years (approximately); in this way, of these 6 million, a “little part” will be used to pay the financing granted by Petrobras in the past.

Now, 6 million seems very low since the total pipeline capacity is close to 30. Then, what Bolivia can do with the rest of the capacity? Here again we come with the famous “take or pay” clause. What this clause implies? I will try, as usual, to explain it through an example.

Now that the end of the year is close you and your friends decided to spend the New Year’s Eve in that restaurant you like so much… yes, yes, the one where more than once you solved the problems of the country and the world with some few beers. The problem arises when 24 of your 30 friends ensure attendance and the rest did not. The owner of the restaurant, friend at last, proposes you the following treatment: “Look, you pay the fee of 24 attendees and if more arrive, I will set the table for 30”. The owner of the restaurant has “for sure” the payment for 24 with the possibility to increase to 30, in fact, he doesn’t care if only 1 comes, since he received the money of 24. In some sense, you and your friends sign a “take or pay” contract for 24 dinners.

Now, let’s put names. We call the owner of the restaurant Bolivia; you and your friends are from Brazil and each dinner is equivalent to 1 million cubic meters per day. Until now, Bolivia was “very happy” because received payment for 24 MM mcd regardless of whether Brazil withdraws it or not, the “take or pay” was very advantageous for Bolivia, because had a “safe” income.

So, the question: How much more will Brazil buy from Bolivia? Could be more precise. What will be the new amount (if any) of the “take or pay” between Bolivia and Brazil? Returning to the example, how many dinners will the owner of the restaurant be assured? 24, 15, 10, 6? Based on some calculations and considering some statements (in Brazil) we estimate (in the paper that I comment) that this “take or pay” can be in the order of 15 MM mcd. Does this imply that Brazil will only be limited to that purchase? Not necessarily, Brazil could well demand higher volumes if the demands of the (Brazilian) market requires.

What could we say about the natural gas export price? Are we competitive? Before the second question the answer is yes and no. If the tax return (approved by the Incentives Law) to the oil companies is met (say tax reduction) then the Bolivian natural gas could compete with the LNG or the domestics gas produced by Brazil. On the contrary, if the companies don’t receive such tax incentive, then will very difficult to reach reasonable levels of competitiveness.

What did I just write? That taxes that Bolivia will receive from natural gas exports will be lower? Is not 50% anymore? The answer is yes. During the administration of the current president, with the Incentives Law approved the Bolivia’s government returns to private companies’ part of the taxes paid. Thus, instead of 50% (by royalties) Bolivia could receive between 35% and 50%.

Also, in this subject many times they ask me: What will be the new price with Brazil? And my respond is: “With high probability it will be lower”. But of course, this vague and shallow answer is because the difficulty to explain in a short time, often in front of cameras or through a microphone, what I will try to do now.

Defining the base price is only half the problem, the other half lies in the index criteria. What? Let’s see. When I write “Index Criteria” I mean how the price will “move” over time. For example, you agree to an initial salary (say USD 1,000 per month) that will be adjusted for inflation each year, in this case, the index criteria is the price growth rate. Another example, you with your couple agree that after getting married you will go at least once a month to “go out to dinner”, after some years it turns out that they go once a year… in this case the index criteria were the children 🙂

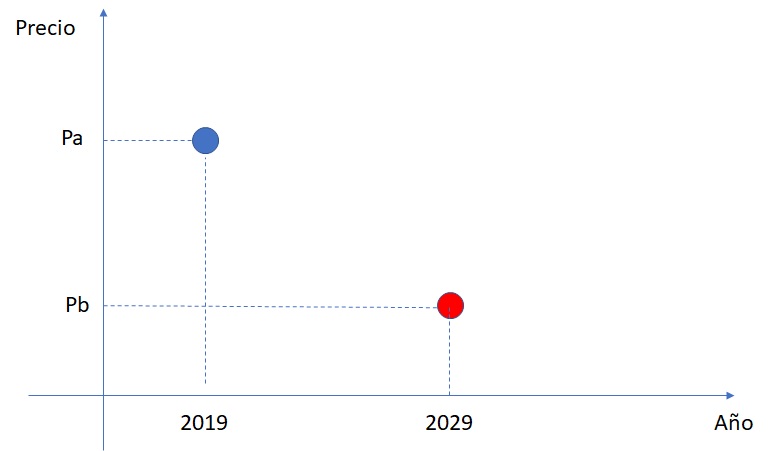

Figure 1 shows a high base price (Pa) in 2019 but, because the index criteria, a low price (Pb) in 2029; in this case, the natural gas seller indexed prices to a falling criteria.

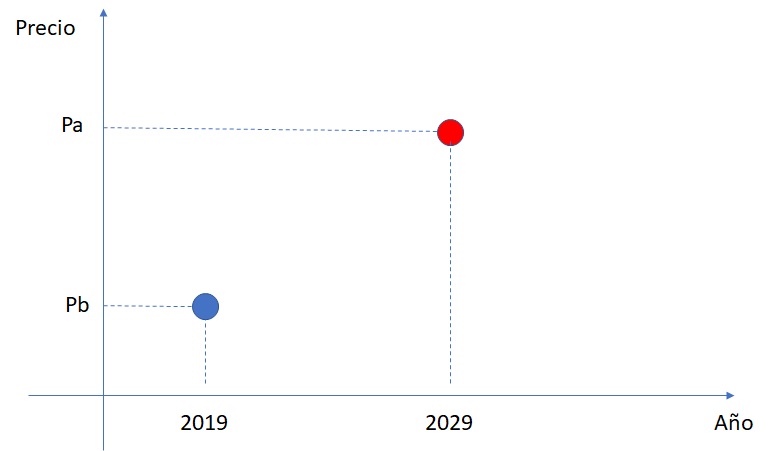

In this second graph, you see a low base price (Pb) in 2019 but, again due to the indez criteria, a high price (Pa) in 2029. In this case, the seller’s position is better. Naturally, as a seller, you can do very bad things: set a low base price and at the same time define a “downward” indexation criteria.

Because nowadays Brazil has domestic gas production (in the 90’s was not the case) both from and LNG access, with high probability, will look for low base prices and not very encouraging (from Bolivia’s perspective) indexation criteria.

In this context, the following question arises: If Brazil and Argentina (the other Bolivian natural gas market) want lower prices and volumes, what other serious alternatives do we have? Can we have the luxury of not accepting unfavourable contractual conditions? Anticipating the possible answers, my comments are:

- The urea industrialization project is very small… 20 times smaller than the sale of gas as a raw material and, worse, with subsidized gas prices.

- Paraguay and Uruguay are very small markets

- Chile is a vetoed option

- Peru has its own gas

Bolivia’s negotiating position is very deteriorated. Just as the last years we harvested the sowing of the evil “neoliberal period”, now it’s time to harvest the sowing of the last 10 years (of the Socialism of the XX1 century).

S. Mauricio Medinaceli Monrroy

La Paz, november 2018

No Comments